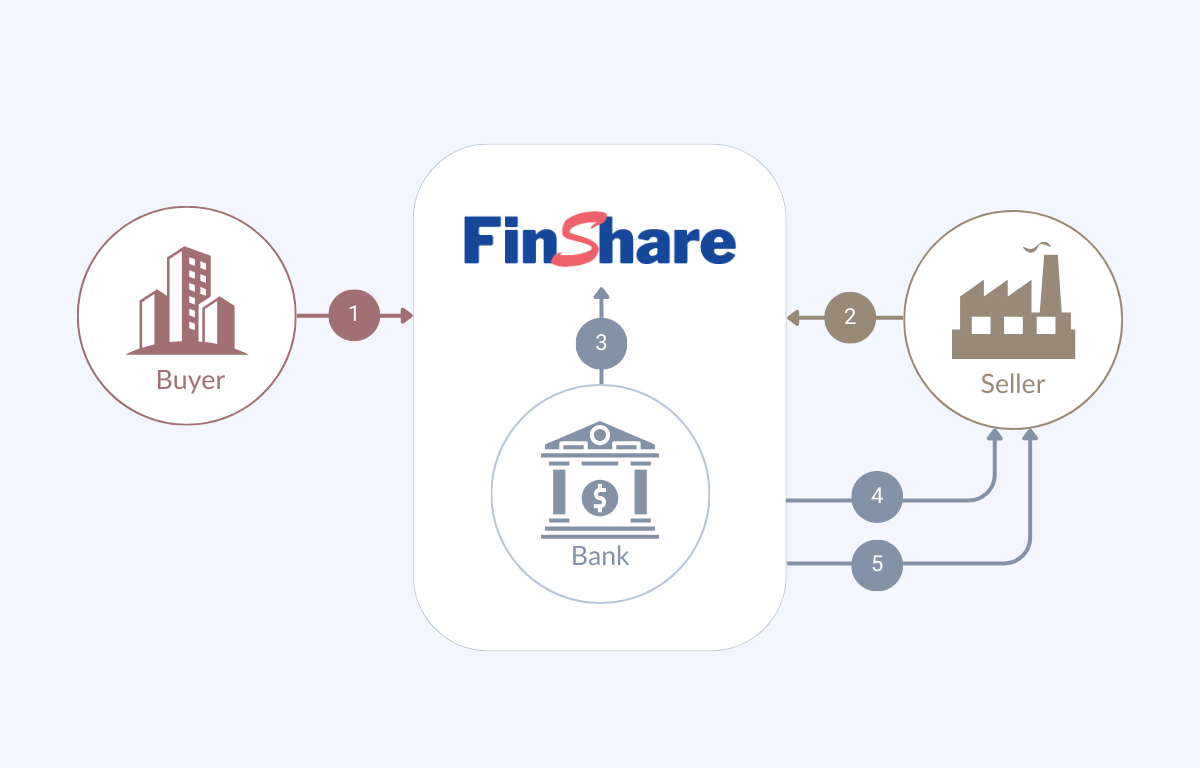

How FinShare Uses Purchase Order Finance to Benefit You

Learn more below about how FinShare uses Purchase Order Finance to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Purchase Order Finance process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Enhanced Information Tracking and Visibility for Buyers and Sellers

FinShare benefits daily operations by enabling discrete tracking and viewing of information for buyers, sellers, and banks. It enhances monitoring, decision-making, collaboration, and financial efficiency in supply chain finance.

Enhanced Compliance through Transaction Audit Trail

FinShare provides daily benefits by maintaining a complete audit trail of transactions for compliance with funding sources and banking regulations. It ensures transparency, accountability, and risk mitigation. Users can confidently track and verify transactions, streamlining compliance management.

Pre-Export Financing: Empowering Buyers and Sellers

FinShare enables buyers to access financing against purchase orders, ensuring funds for export requirements. Sellers can obtain financing against the Pro-Forma, meeting production and shipment obligations. With FinShare, stakeholders secure financial resources for pre-export activities, fostering growth in the supply chain ecosystem.

Seamless Integration for Streamlined Supply Chain Management

FinShare's seamless integration enables streamlined supply chain management. Buyers, sellers, and banks benefit from a unified platform, eliminating system fragmentation. Real-time data flow, accurate tracking, and comprehensive reporting optimize daily operations. With FinShare's integration, stakeholders achieve transparency, collaboration, and financial success.

Post-Export Financing: Empowering Buyers and Sellers

FinShare enables buyers to finance inventory/payables and helps sellers obtain financing against the commercial invoice. It optimizes cash flows, improves liquidity, and fosters growth in the supply chain ecosystem.